This article is regarding when you are registering a UK car in Spain and waiving the taxes which are made up of basically import duty and IVA (VAT). Unfortunately after Brexit things changed dramatically for waiving taxes. However, if you are taking residency in Spain and you follow a timeline of doing things properly waiving the taxes should be straight forward.

Signing on the Padron in Spain.

Signing on the Padron simply (no matter what you are told) should not be done UNTIL you have your residency , or, at least very close together to receiving your residency and the Padron being registered. Signing on the Padron is basically telling the Spanish tax office you are ALREADY resident in Spain whether you have been living in Spain or not. However, if you have your residency arriving soon or have in the last 12 months gotten your residency to be able to waive taxes you must prove to the Spanish government that you have informed HMRC you are leaving the country by filling in a P85 form.

This used to be a troublesome ask as many people do not even know about the P85. The great news is you can backdate the form which must be PRE signing of the Padron and PRE residency dates. here we will explain what you need to do to get the summary page we need to prove you left the UK and potentially waive taxes for you. There a 2 ways to inform HMRC.

- Filling an online form, printing off and sending to HMRC by post (this takes a long time to get a confirmation letter)

- Filling in the HMRC website and getting an instant summary on submitting (This is enough to prove you informed HMRC you left the UK for the Spanish tax office to potentially waive taxes)

To fill in the P85 head over to HMRC’s P85 for online service Click here. To use the online service, you need a Government Gateway user ID and password. If you do not have a user ID, you can create one when you use the service. If you use the online form, you’ll get a reference number that you can use to track the progress of your claim.

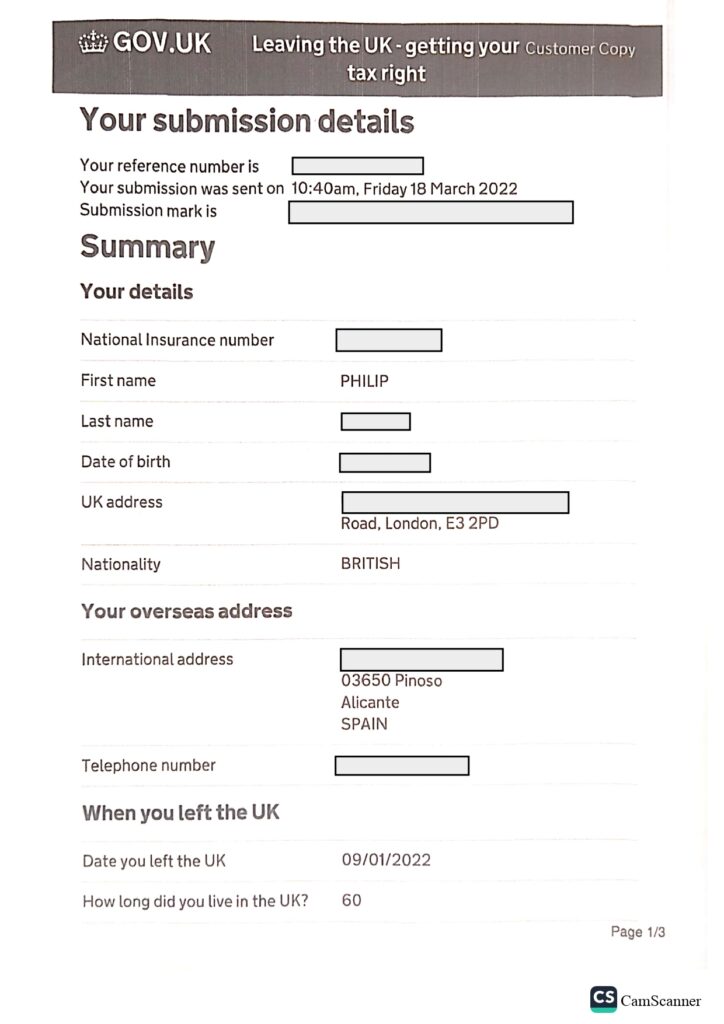

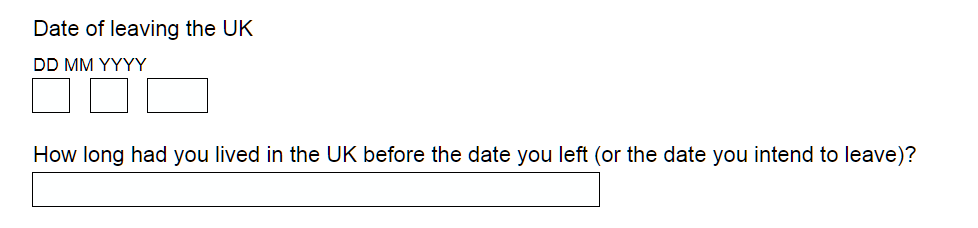

Fill the form REMEMBER THE DATE OF LEAVING THE UK MUST PRE DATE THE PADRON AND THE RESIDENCY APPROVAL. once done you will receive a summary page like the one below. We have obviously removed sensitive information from the form. Once you have submitted this form you get the below summary. please send us this summary page (3 pages) we will then use to see if we can waive the import duty and IVA>

The above section for the date MUST pre date the signing of the Padron and the the date you got residency. If date is pending no problem.

Once you have filled in the form you then need to SAVE the submission form this is an example below. This is enough to satisfy the Spanish tax office you have informed the UK you left the UK and should enable us to waive taxes.